washington state capital gains tax rate 2021

In the 2021-23 biennial state budget. Explore 2021 ballot measures and see Washington election results.

Capital Gains Tax Calculator 2022 Casaplorer

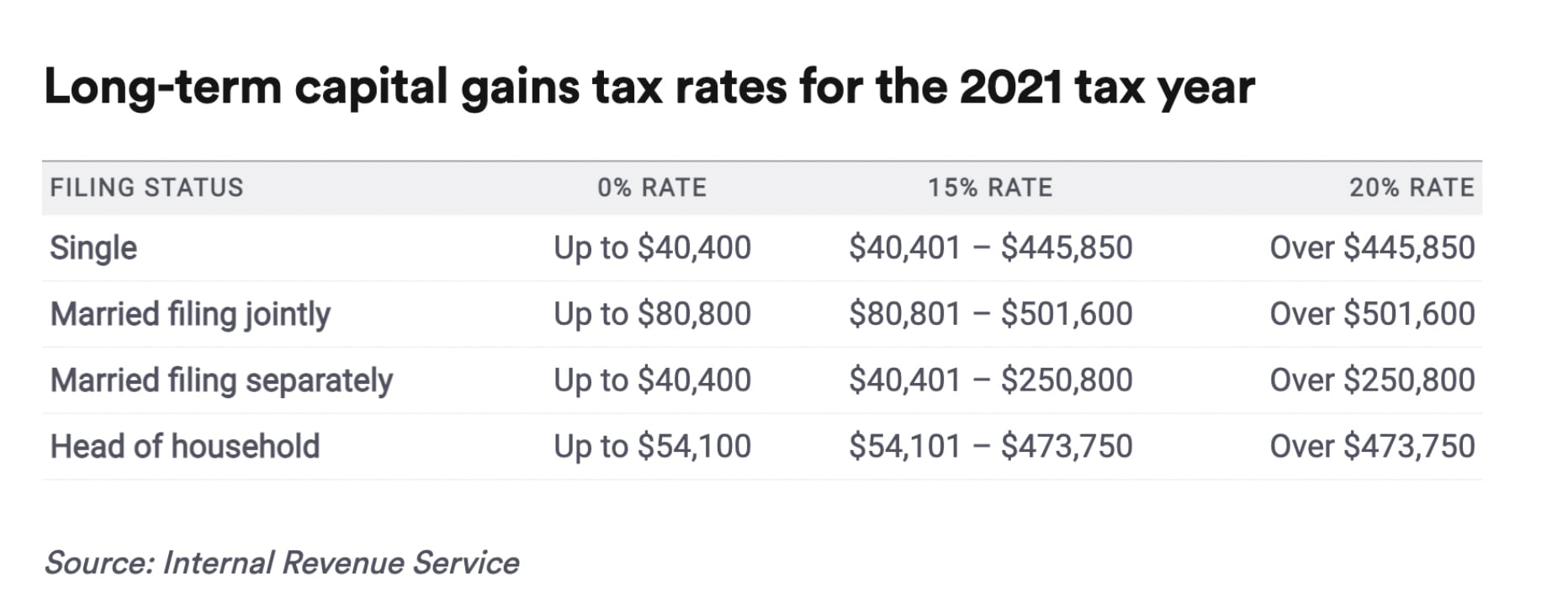

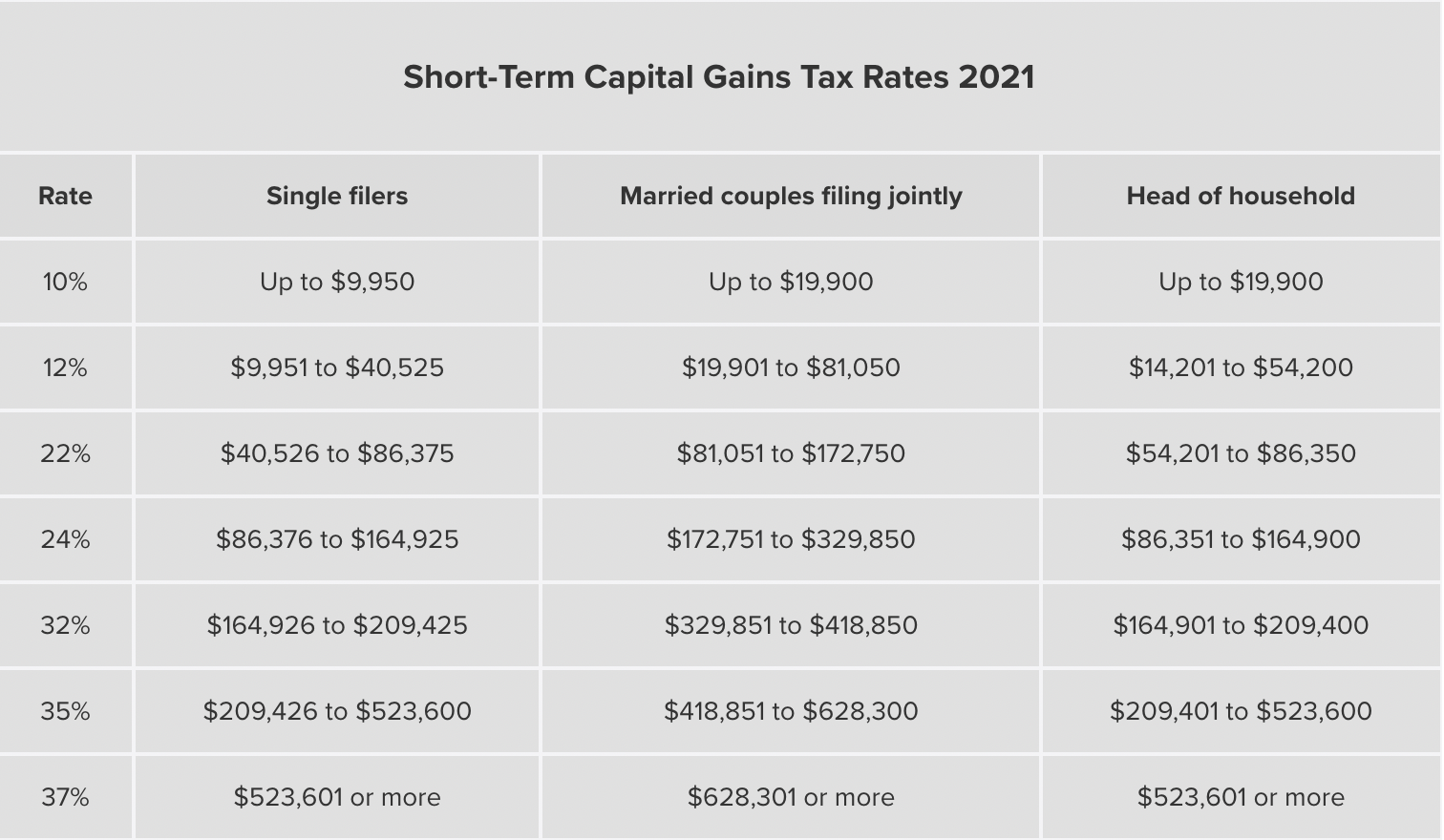

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and. Beginning January 1 2022 Washington state has instituted a 7 capital gains tax on Washington long-term capital gains in excess of 250000. Get Access to the Largest Online Library of Legal Forms for Any State.

1 2021 E2SHB 1477 Chapter 302 Laws of 2021. Learn more about the Washington capital gains income tax Washington capital gains tax. 1 2023 the tax rate increases to 40 cents.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. 5096 on May 4 2021 Washington state will begin imposing a 7 percent tax on certain long-term capital gains beginning January. Ad The Leading Online Publisher of National and State-specific Legal Documents.

The tax is generally imposed on. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business. In March of 2022 the Douglas County Superior Court ruled in Quinn v.

5096 which was signed by Governor Inslee on May 4 2021. The new capital gains tax applies to individuals. The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments.

Senate Bill 5096 will impose a 7 tax on excessive capital gains of 250000 or more. On 4 May 2021 Governor Inslee signed Engrossed Substitute Senate Bill 5096 the Act establishing a state-level tax on long-term capital gains for Washingtonians beginning 1. Washington enacts individual capital gains tax.

Washington recently enacted a capital gains tax with the signing of SB 5096 by Gov. For the tax to kick in an individual. Given the legal facts the state supreme court should reject the latest attempt to circumvent the will of the people as clearly expressed in the constitution and at the ballot box.

As a result of Governor Jay Inslee signing SB. The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments. Capital Gains Tax Rates in Other States.

The new law will. The 7 capital gains tax applies to profits from selling long-term assets such as stocks and bonds. Includes short and long-term Federal and.

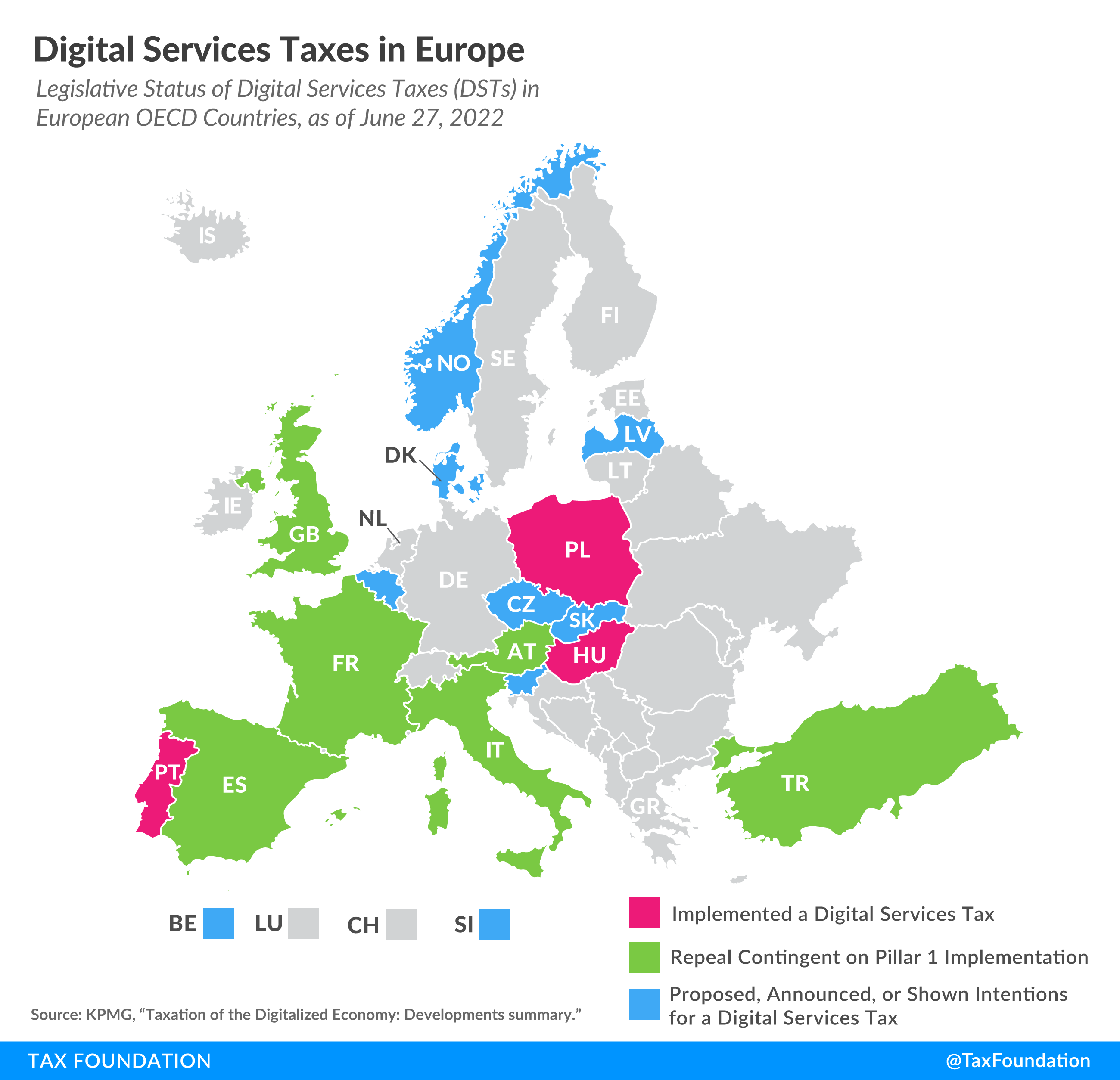

As for the other states capital gains tax rates are as follows. 2021 federal capital gains tax rates. Jay Inslee effective January 1 2022.

Jay Inslee on Tuesday signed into law a new tax on capital gains aimed at the states wealthiest residents. State of Washington that the capital gains excise tax ESSB 5096. Capital gains are the profits made on the sale of investments such as stocks bonds and.

New excise tax to fund statewide. The Washington State Supreme Court today expedited the ultimate resolution of the Freedom Foundations lawsuit challenging the capital gains income tax bill passed by the. Jay Inslee recently signed legislation imposing a 7 tax on the long-term capital gains LTCG.

Taxes capital gains as income and the rate reaches 5. Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

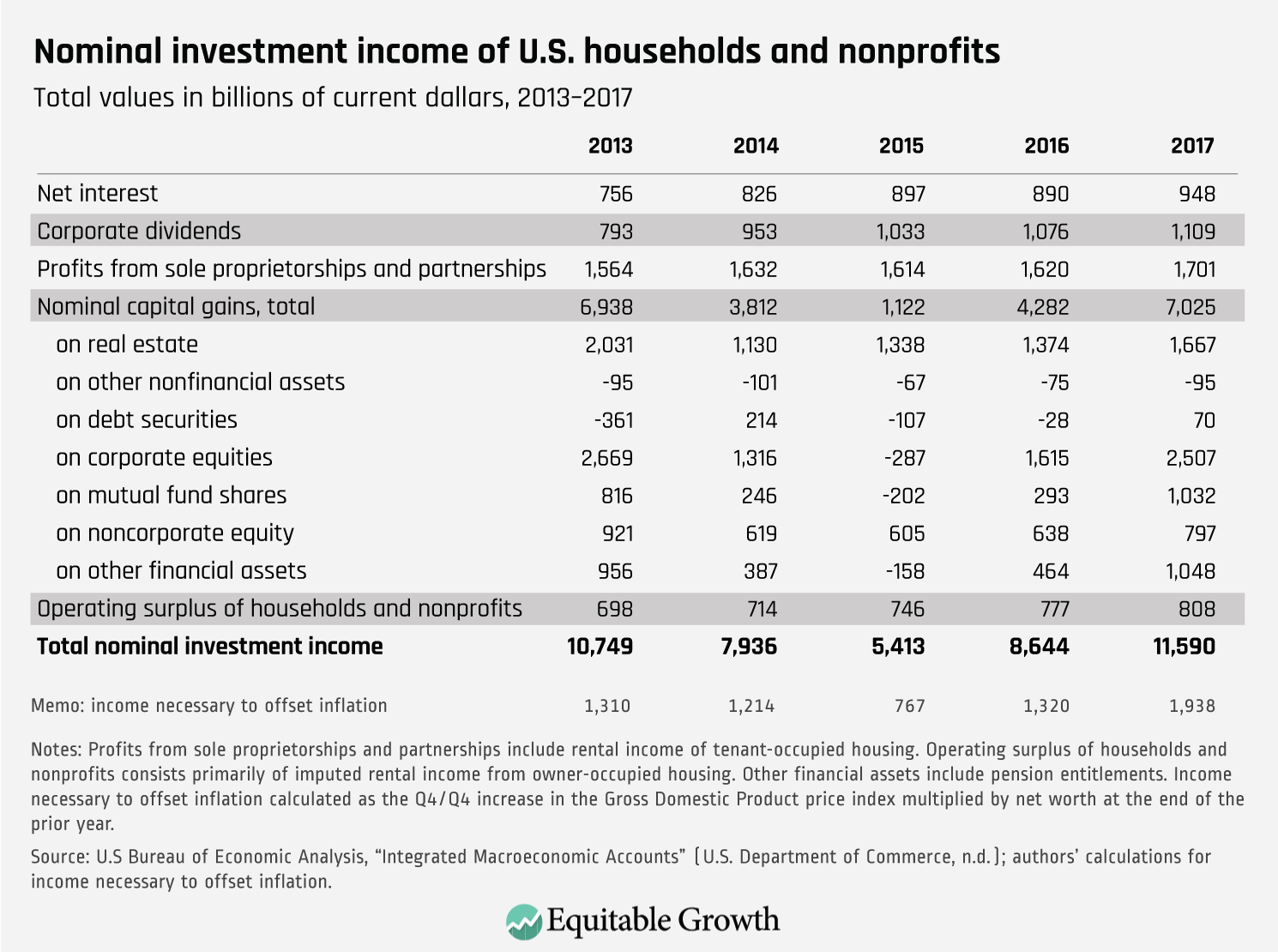

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

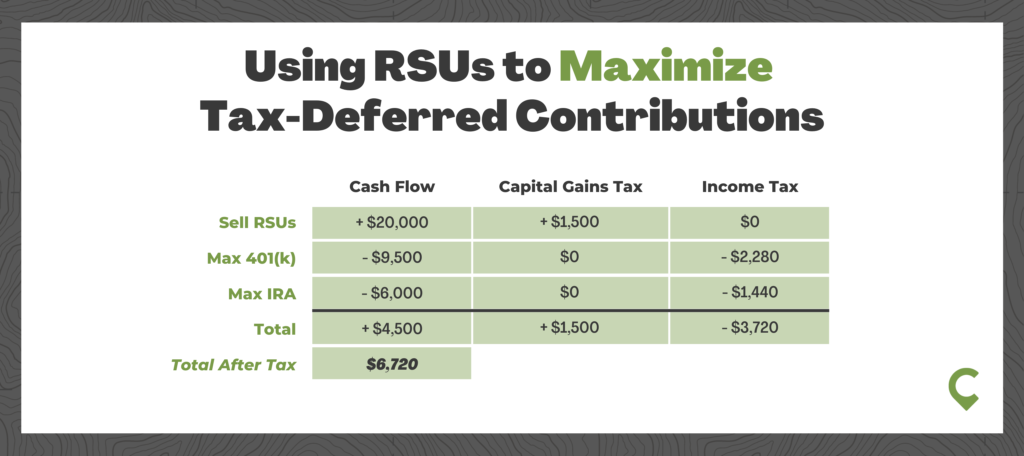

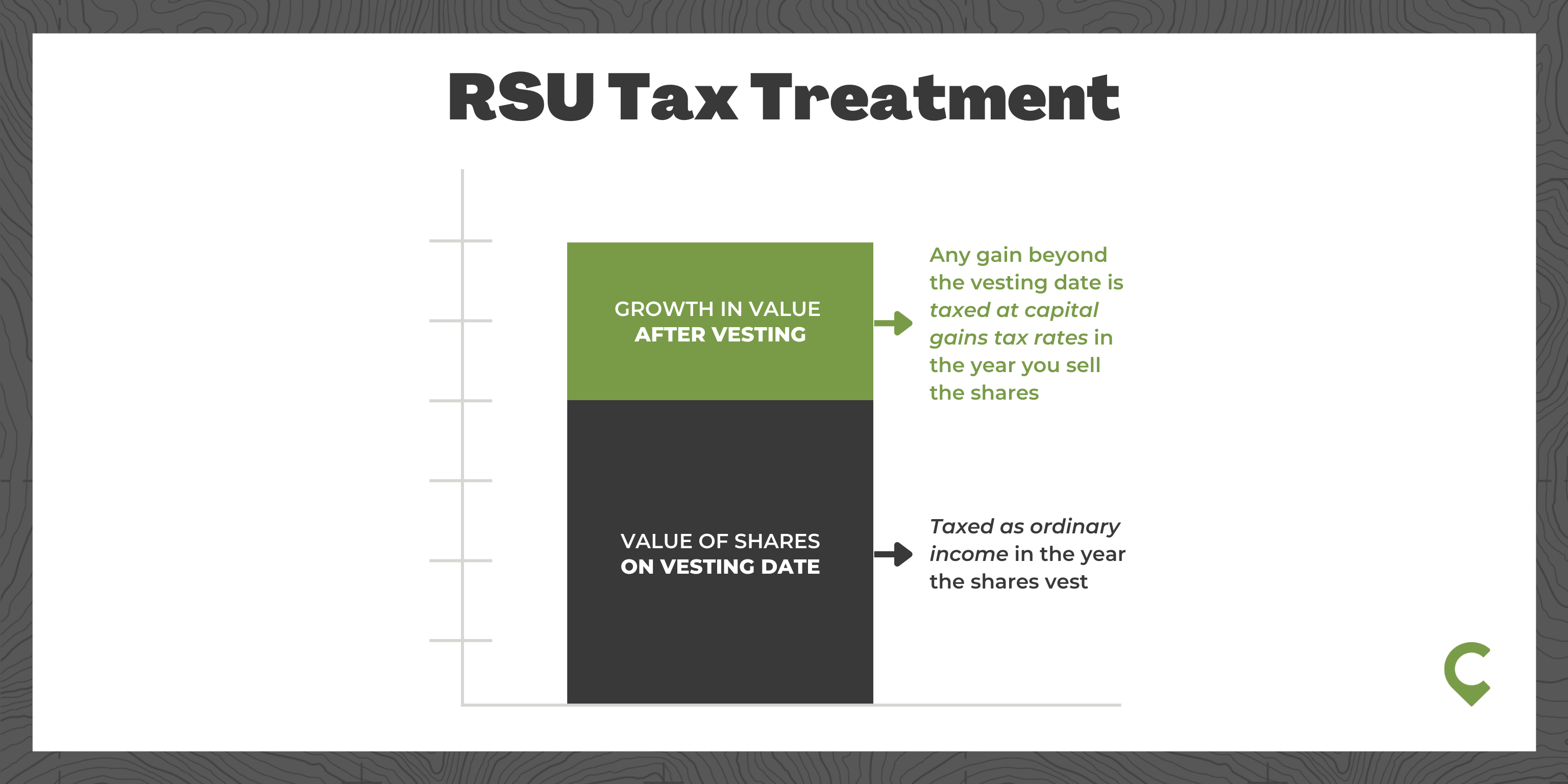

Rsu Taxes Explained 4 Tax Strategies For 2022

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Idaho Income Tax Calculator Smartasset

Turkey Tax Income Taxes In Turkey Tax Foundation

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Bracket Creep Definition Taxedu Tax Foundation

Capital Gains Tax On Stocks What You Need To Know

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Capital Gains Tax On Stocks What You Need To Know

Overview Of Washington State Tax Law Changes Beginning January 1 2022 Neither Definitive Lasher Holzapfel Sperry Ebberson Pllc Jdsupra

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Sec 199a And Subchapter M Rics Vs Reits

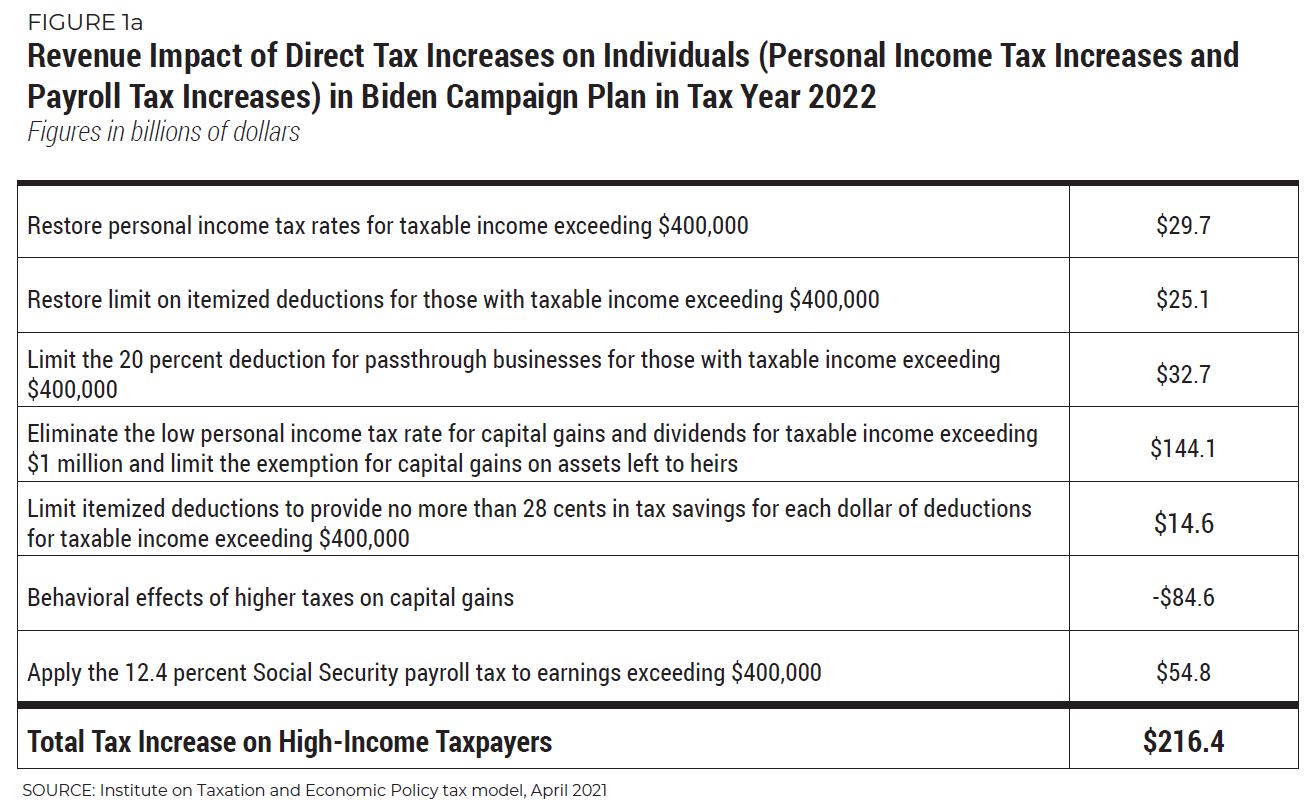

Proposed Tax Changes For High Income Individuals Ey Us